When it comes to Medicare, you have two main options: Original Medicare and Medicare Advantage. Both provide essential healthcare coverage for seniors and those with certain disabilities, but they differ in structure, costs, and coverage. Deciding between these options depends on your healthcare needs, financial situation, and lifestyle. This article will explore the pros and cons of Medicare Advantage and Original Medicare, helping you make an informed decision that best suits your individual needs.

Understanding Original Medicare

Original Medicare consists of two parts:

- Medicare Part A (hospital insurance) covers inpatient care, nursing facilities, and hospice care.

- Medicare Part B (medical insurance) covers outpatient services, including doctor visits, preventive care, and medical supplies.

Original Medicare is a federal program, meaning coverage and costs are standardized across the country. It does not include prescription drug coverage (Part D), so beneficiaries often purchase separate plans to cover medications. Additionally, many people supplement their Original Medicare coverage with Medigap plans to help pay for out-of-pocket costs like deductibles and coinsurance.

Pros of Original Medicare

- Wide provider network: Original Medicare is accepted by most healthcare providers and hospitals across the U.S., giving you flexibility to see almost any doctor or specialist who accepts Medicare.

- No referrals required: You don’t need referrals to see specialists, making it easier to access care when you need it.

- Predictable costs with Medigap: When paired with a Medigap plan, Original Medicare provides predictable costs for covered services, helping to reduce out-of-pocket expenses.

- Nationwide coverage: Original Medicare provides coverage anywhere in the U.S., making it an excellent option for those who travel frequently or live in multiple states throughout the year.

Cons of Original Medicare

- No prescription drug coverage: You must purchase a separate Part D plan to cover prescription medications, which adds to your monthly premiums.

- No additional benefits: Original Medicare does not offer extras like dental, vision, or hearing coverage, which are often included in Medicare Advantage plans.

Out-of-pocket costs: Without a Medigap plan, you may face significant out-of-pocket expenses, as Original Medicare only covers 80% of your Part B medical costs.

Understanding Medicare Advantage

Medicare Advantage (Part C) plans are offered by private insurance companies and bundle Medicare Parts A and B into a single plan. Many Medicare Advantage plans also include prescription drug coverage (Part D) and additional benefits, such as dental, vision, hearing, and even wellness programs. Medicare Advantage plans operate within a network, meaning you’ll need to see providers who are part of the plan’s network.

Pros of Medicare Advantage

- All-in-one coverage: Medicare Advantage combines hospital, medical, and often prescription drug coverage into one plan, simplifying your healthcare coverage.

- Additional benefits: Most plans offer extra benefits like dental, vision, hearing, and wellness programs that are not included in Original Medicare.

- Lower premiums: Medicare Advantage plans often have lower or $0 premiums. In 2024, the average monthly premium for Medicare Advantage is projected to be about $18, but many plans have no premium at all.

- Out-of-pocket maximum: Unlike Original Medicare, which does not have an out-of-pocket cap, Medicare Advantage plans have a maximum limit on how much you’ll spend in a year on covered services. Once you hit this limit, the plan covers 100% of your healthcare costs for the rest of the year.

Cons of Medicare Advantage

- Limited provider network: Medicare Advantage plans typically require you to use healthcare providers within a specified network, which may limit your choice of doctors or hospitals.

- Referrals required: Some Medicare Advantage plans, especially Health Maintenance Organization (HMO) plans, require you to get a referral from your primary care doctor before seeing a specialist, which can slow down access to certain types of care.

- Regional limitations: If you travel frequently or split your time between different states, Medicare Advantage plans may not provide coverage outside of their designated service area, which can be problematic for frequent travelers.

Variable costs: While premiums can be low, you may face higher out-of-pocket costs for services like specialist visits, hospital stays, or surgeries, depending on your plan. These costs can add up quickly, particularly if you need frequent medical care.

How to Decide: Key Factors to Consider

Choosing between Medicare Advantage and Original Medicare depends on your healthcare needs, lifestyle, and budget. Below are some key factors to consider:

1. Your Healthcare Needs

If you have chronic conditions or anticipate needing regular medical care, Original Medicare paired with a Medigap plan may offer more predictable costs. Medicare Advantage plans can be cost-effective for healthy individuals who don’t need frequent care, but out-of-pocket expenses can add up quickly if you need extensive medical services. The out-of-pocket maximum in Medicare Advantage plans is a safety net, but it can still be higher than the combination of Original Medicare and a Medigap plan.

2. Prescription Drug Coverage

If you take multiple medications, check the cost and coverage of prescription drugs under Medicare Advantage versus enrolling in a standalone Part D plan with Original Medicare. Some Medicare Advantage plans may cover your medications at a lower cost, but drug formularies can vary, and not all plans cover every prescription.

3. Provider Access

For those who value freedom in choosing their healthcare providers, Original Medicare is likely the better option. You can see any doctor or specialist who accepts Medicare, and there’s no need to worry about network restrictions. Medicare Advantage plans, while potentially less expensive, may require you to stick to a more limited provider network.

4. Additional Benefits

Medicare Advantage plans can be an appealing choice if you want extra benefits like dental, vision, or hearing coverage. Original Medicare does not cover these services, and private insurance for these extras can be costly. If these services are important to you, Medicare Advantage may offer better value.

5. Cost Considerations

Compare the total costs of both options. Original Medicare has standard premiums for Part B and additional costs for Part D and Medigap plans, but you can predict your expenses with supplemental coverage. Medicare Advantage often has lower premiums, but out-of-pocket costs for care can fluctuate based on your health needs. If you are on a tight budget, the all-in-one nature and potential savings of Medicare Advantage might be appealing.

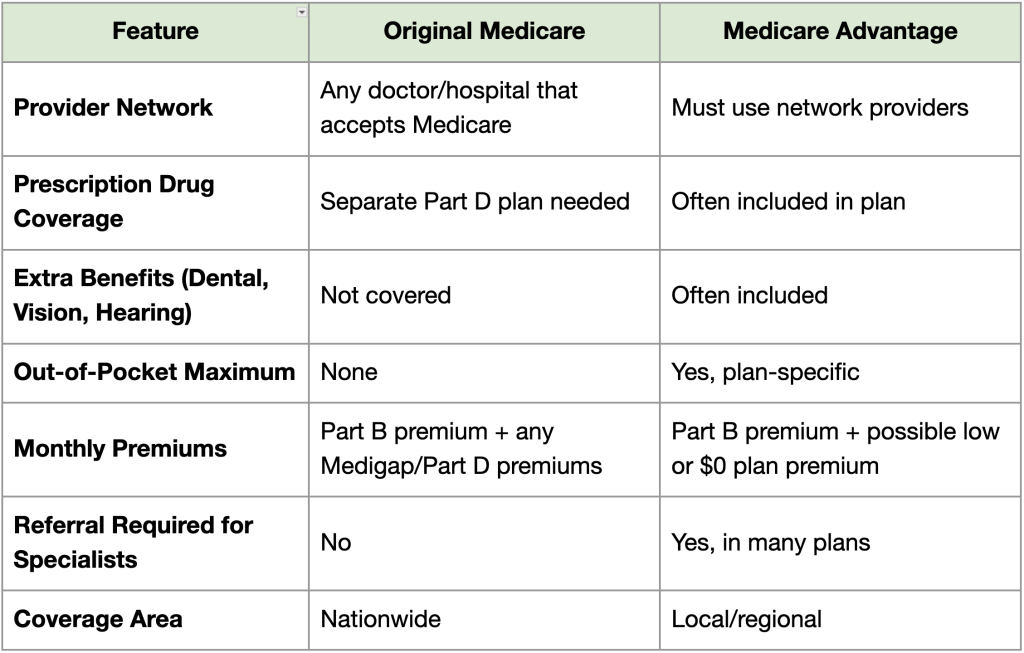

Medicare Advantage vs. Original Medicare: A Side-by-Side Comparison

Making Your Decision

The best way to decide between Medicare Advantage and Original Medicare is to assess your individual needs and circumstances. Consider factors like how often you visit doctors, whether you need extra benefits, how much flexibility you want with your providers, and your financial situation.

If you value broad access to healthcare providers and prefer more predictable out-of-pocket costs, Original Medicare with a Medigap plan may be your best bet. On the other hand, if you’re looking for lower premiums, extra benefits, and don’t mind staying within a network of providers, Medicare Advantage could be the right choice.

For more information, visit Medicare.gov to compare your options and explore available plans.